1 - Introduction

This global salary survey is the largest completed to date that focuses specifically on the Microsoft Dynamics community. The objective of the survey is to gain greater insight into remuneration trends and it will be conducted annually in order to gauge any emerging developments and provide further insight and understanding. The 2009 survey was conducted from the 29th September 2009 through to the 30th November 2009. The 2009 survey was conducted from the 29th September 2009 through to the 30th November 2009 and was marketed to the Dynamics community through the biggest Dynamics user groups, blogs and forums as well as the Nigel Frank candidate database.

After cleansing the survey responses, a population of over 5,800 individuals form the basis of the analysis. This represents the views, predominately of people from Europe (62%) and North America (22%), who either work or have worked in the Microsoft Dynamics community. A large majority of the respondents were in permanent employment (79%) compared to contract/freelance (17%).

Although the survey received responses from Dynamics professionals based in 98 different countries, this report will concentrate on the replies received from 17 of these countries where the sample size is sufficient to draw firm conclusions. These 17 countries are Austria, Australia, Belgium, Canada, Denmark, Finland, France, Germany, Ireland, Italy, Netherlands, Norway, Spain, Sweden, Switzerland, UK and the USA.

2 - Key Findings

Permanent

• Average European basic salary is €48,349 with a 9.3% benefits package

• Average North American basic salary is €55,529 with a 14.7% benefits package

• Less than 15% of people have seen their salary decline in 2009

• Less than 3% of respondents are currently not working

• Lack of training is the biggest cause of employee dissatisfaction

• 35% of respondents do not expect to be with their current employer in 12 months time

Contractor/Freelancer

• Average European daily rate is €534

• Average North American daily rate is €493

• 22% of respondents have seen their daily rates decline in 2009

4 - Salary Results - Permanent (Full-time)

Initially, the report will concentrate on the population of respondents who are in full-time permanent employment. By splitting this sample set into 4 geographical regions the table below shows the average basic salary and the average value of benefits (including bonus/commission) of all permanently employed respondents. Results are shown in Euros

Now by focusing on just the respondents from the 17 countries mentioned in the introduction we get a distribution of salaries for Microsoft Dynamics professionals in permanent full-time employment as follows

4.7 Popular Benefits – (permanent employees only)

The chart below provides a look at the percentage of respondents that had the listed benefits as part of their employment package. Mobile phones and laptops top the list while 44% of people stated that they had the option to work from home in some form. This figure may be slightly inflated as consultants and sales people who spend a significant time visiting other companies, often regard themselves as working from home.

4.8 Microsoft Partner vs End-User

Just over 71% of permanently employed respondents stated that they were working for a Microsoft Partner or Solutions Provider whilst over 22% were working for End Users or Microsoft Dynamics customers. The remainder of the respondents were made up of those either working for Microsoft or Independent Software Vendors.

From the survey we identified three predominant job titles (Project Manager, Developer and Support) for respondents working for either a Microsoft Partner or a Microsoft Customer (also referred to as an End User). Then by analysing the average basic salary for these permanent employees we are able to produce the chart below showing the difference in salaries measured against the classification of the employer.

Unsurprisingly, End Users will pay more for experienced project managers to help oversee implementations and upgrades. On the other hand developers and support staff are paid better when working for Partners. This pay difference is likely to be explained by the fact that the more experienced and knowledgeable people tend to be found working for Partners where they are involved more in the front-end development of the Dynamics suite and are the first to be exposed to newer versions of the software

5 - Salary Results - Contractor/Freelance

Interestingly, although Europe lagged behind both North America and Australasia in terms of average salary for permanent employees it appears that when it comes to contractors/freelancers Europeans, on average, are paid significantly more. It should be noted that there are more contractors/freelancers in Europe who have significant experience in AX and/or NAV as these products have been established in these countries longer than other parts of the world. Naturally the daily rates for these experienced individuals are at the higher end of the scale as they attract a global demand for their services

The table below looks at respondents employed as Consultants or Developers and compares the average annual remuneration of permanent employees versus that of contractors/freelancers by multiplying daily rates by 230 days (assumes 30 days for public holidays/annual leave/sick).

What we see is that contractor's annual remuneration tends to be in the region of twice that of a permanent employee. There are several reasons that explain why contractors/freelancers are paid more than permanent employees with job security being one of the main ones. However, even in the current economic climate, there appears to be no evidence that contractors/freelancers with technical experience are more likely to be unemployed or having trouble finding a new role than permanent employees.

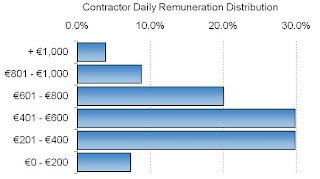

The table below bands the contractor/freelance population based on their daily pay rate and shows that the majority earn between €200 and €600.

Not all of the job titles listed in the permanent salary analysis are relevant for contract analysis as employers are unlikely to award various positions, such as IT Director, to contractors. Therefore the list of job titles is reduced for contractors and the rates per country are as follows:

5.5 Microsoft Partner vs End-User

Similar to permanently employed respondents, the majority of contractors (58%) worked for a Microsoft Dynamics Partner / Solutions Provider. The remainder was split with 36% working for End Users and 6.3% for other organisation types. However, when looking at the remuneration between the two different types of organisation there was no material variance found.

6 - Dynamics Product Knowledge

Nearly 44% of all respondents indicated they had Dynamics NAV experience with over half stating they had been working with the product for at least 5 years. Interestingly, over 23% of respondents claimed to have experience with 2 or more of the Microsoft Dynamics products. However, it was not surprising to find that it was sales related positions that showed the most cross-product knowledge with more technical positions such as development and programming showing the least.

Dynamics CRM, as the 'youngest' of the four core products, received the lowest number of responses for 5 years+ experience but interestingly had the highest number of responses for less than 2 years. This mirrors Nigel Frank's experience that Dynamics CRM is the biggest growth area in terms of Dynamics staffing.

The above graph shows the product knowledge from all respondents but when we drill down to country level there are some large differences reflecting product usage within that country (i.e. GP was originally a US product and has only really made it to Canada, Australia, UK & Ireland). Below are the product knowledge results for respondents based on country of employment for a select few countries.

If the contractors experience figures are taken out and presented separately it is no surprise to see that contractors are overall more experienced (see table below):

9 - Male dominated As we know the IT industry is largely male dominated and the Dynamics community is no different with only 13% of respondents being female. This is more indicative of gender profession preferences rather than being a sign of sexism within the IT industry and is representative of results found across more generalist IT surveys.

When looking at the average level of pay we see another all too familiar pattern as globally women appear to be taking less pay home.

What the table above shows is that, after graduating and joining a company, both men and women start off at roughly the same salary level. Then as they move into the age bands associated with having children, the females seem to lose ground on their male colleagues. Yet as we progress into the later age groups the pay difference is eradicated and the females even surmount the males at the top of the salary chart. This would suggest that the salaries of female professionals are impacted during the years associated with rearing children as a larger percentage sacrifice their career in comparison to their male colleagues.

10 - Pay Movement

Just over 40% of respondents in permanent employment stated that they had received an increase in salary whilst just over 47% had seen no change. The remaining 13% of respondents had actually experienced a reduction in their salary over the last 12 months.

Contractors/Freelancers on the other hand had very mixed movement in rates. Whilst the majority of respondents (52%) reported no movement, 22% had seen a decrease in rates while only 26% received an increase in rates. This implies that, whilst there is still demand for contractor skills, many employers are lowering the rates that they are willing to pay them as they are scrutinising all outgoings much more closely.

12 - Conclusion

Overall the results look promising for professionals with Microsoft Dynamics skills or experience. The average salary is considerably higher than the national averages for any of the countries analysed in this report and overall the salary movement over the last 12 months has been positive for permanently employed people while contractor rates, on average, have remained the same. Demand for Dynamics professionals appears to be holding up well against the global economic downturn, especially for the more technically skilled employees. Developers and support staff seem to be better paid at Microsoft Partners while Project Managers do better at Microsoft Customers. There appears to be confidence in the market amongst Dynamics professionals, with 35% of them believing they will move on to another job within the next year. While the market is male dominated, it does appear that women can earn just as much as men, if not more